How Can I Qualify for a Mortgage in Johnson County, TX in 2026?

Greetings from Burleson! I'm Kassaundra, your Johnson County real estate specialist. "How do I qualify for a mortgage?" is buzzing this week as rates stabilize and buyers gear up. Here's your local guide.

Qualification hinges on credit, income, debt, and down payment. Aim for a 620+ credit score; anything lower might need FHA loans common in Texas. Debt-to-income ratio should be under 43% calculate yours by dividing monthly debts by gross income.

In Johnson County, with homes at $340K median, expect 3-5% down for conventional loans, or zero for VA if eligible. Local programs like Texas State Affordable Housing Corporation offer aid for first-timers.

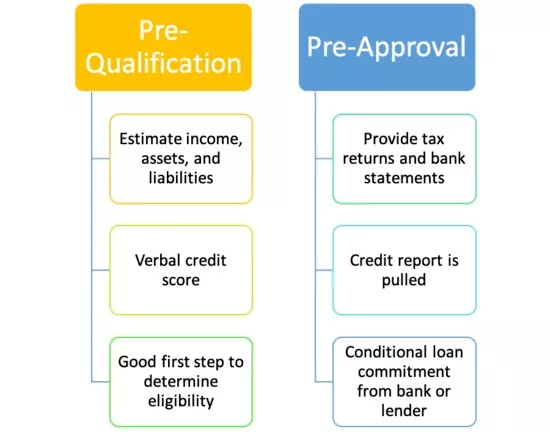

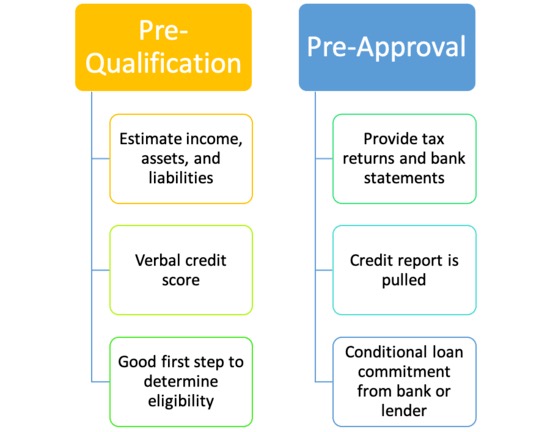

Steps: Get pre-approved early lenders review pay stubs, tax returns, and bank statements. Shop rates; 2026 forecasts suggest slight drops, boosting affordability.

Buyers: Strong qualification means better offers in our balanced market. Sellers: Know buyers' financing to avoid delays.

Struggling to qualify? I connect clients with trusted lenders. Reach out for tips or referrals—let's get you home!

${companyName}

Phone